(919) 964-0704

Welcome to Medicare Basics!

Whether you’re new to Medicare or just want to understand it a little better, this is a great place to start. Here, you can learn:

- What Medicare is

- The different parts to Medicare and what they cover

- The costs of different types of coverage

- How to sign up

This guide will help you make a more informed choice about your health

care coverage.

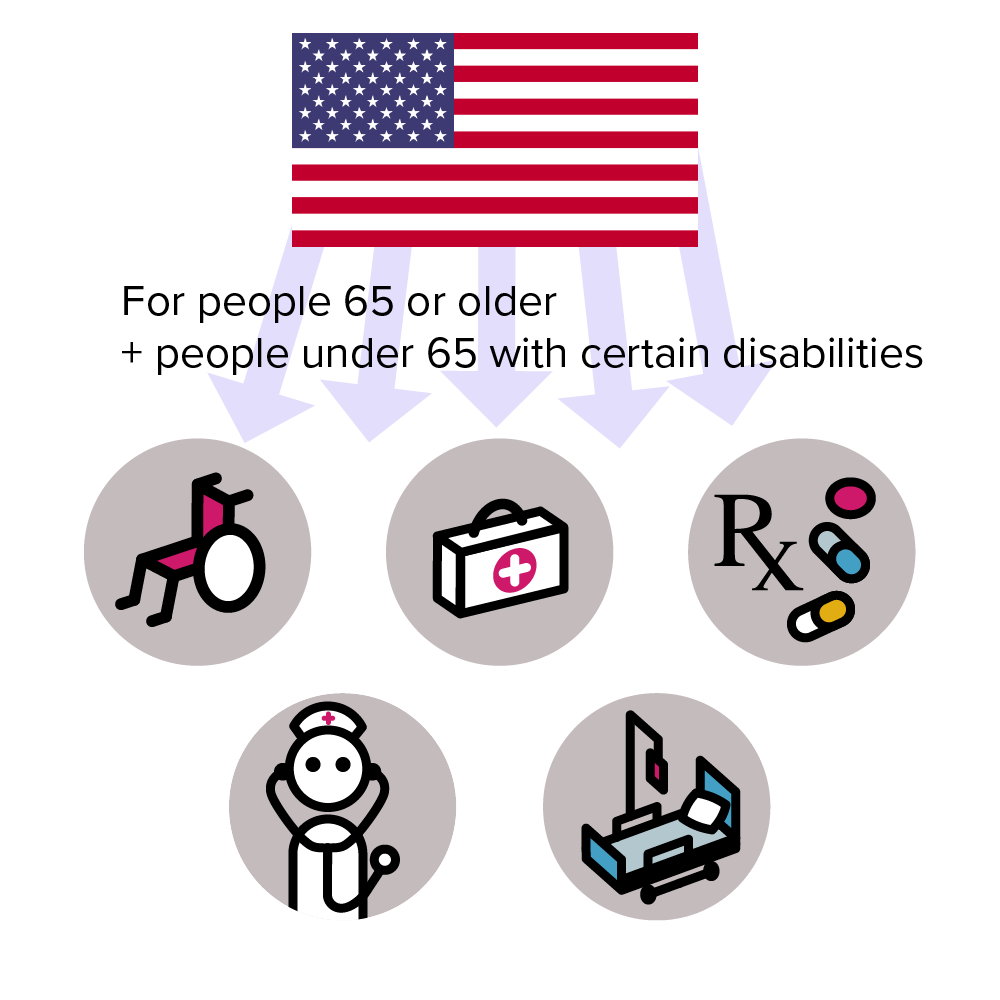

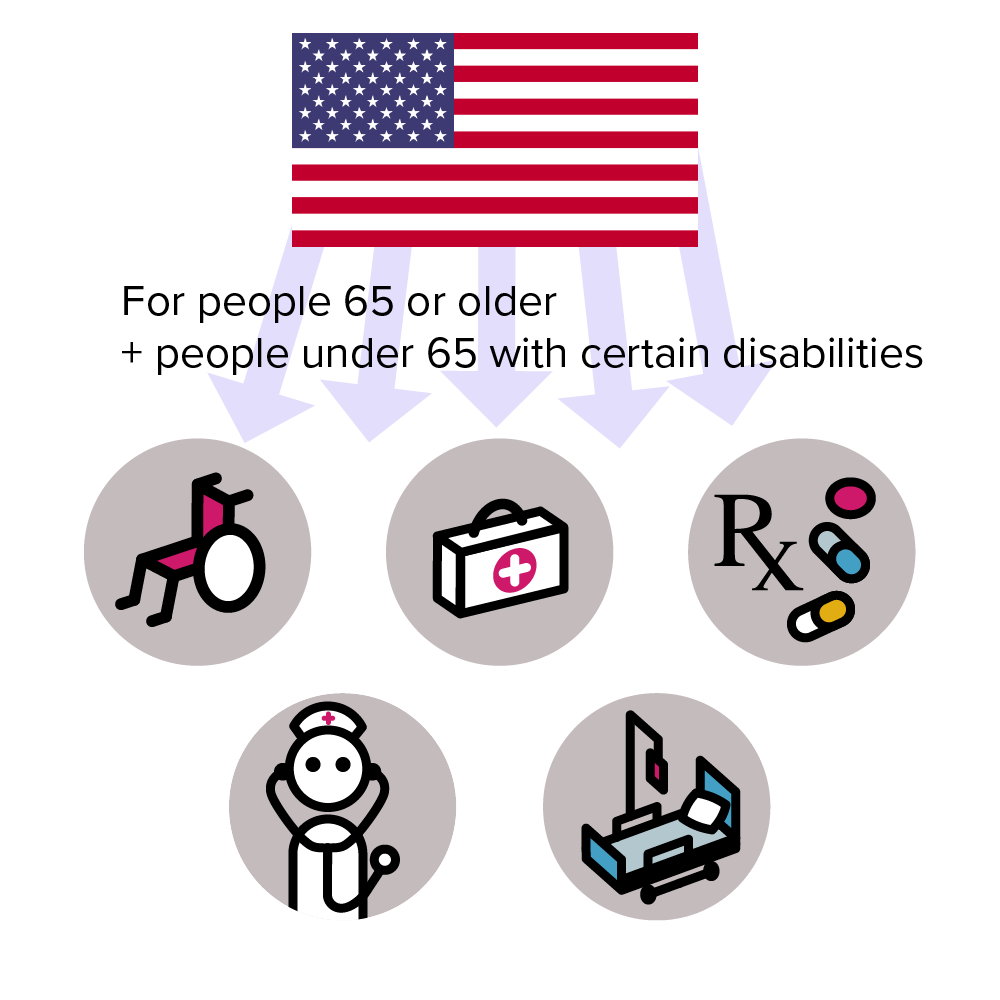

What is Medicare?

Medicare is a federal insurance program that provides health insurance for American citizens and permanent residents age 65 and older, as well as certain people under age 65 who may qualify for Medicare due to a disability.

When and how can I first sign up for Medicare?

You can first sign up for Medicare during your Initial Enrollment Period. This is a 7-month period which includes 3 months before you turn 65, your birthday month itself, and 3 months after your 65th birthday month.

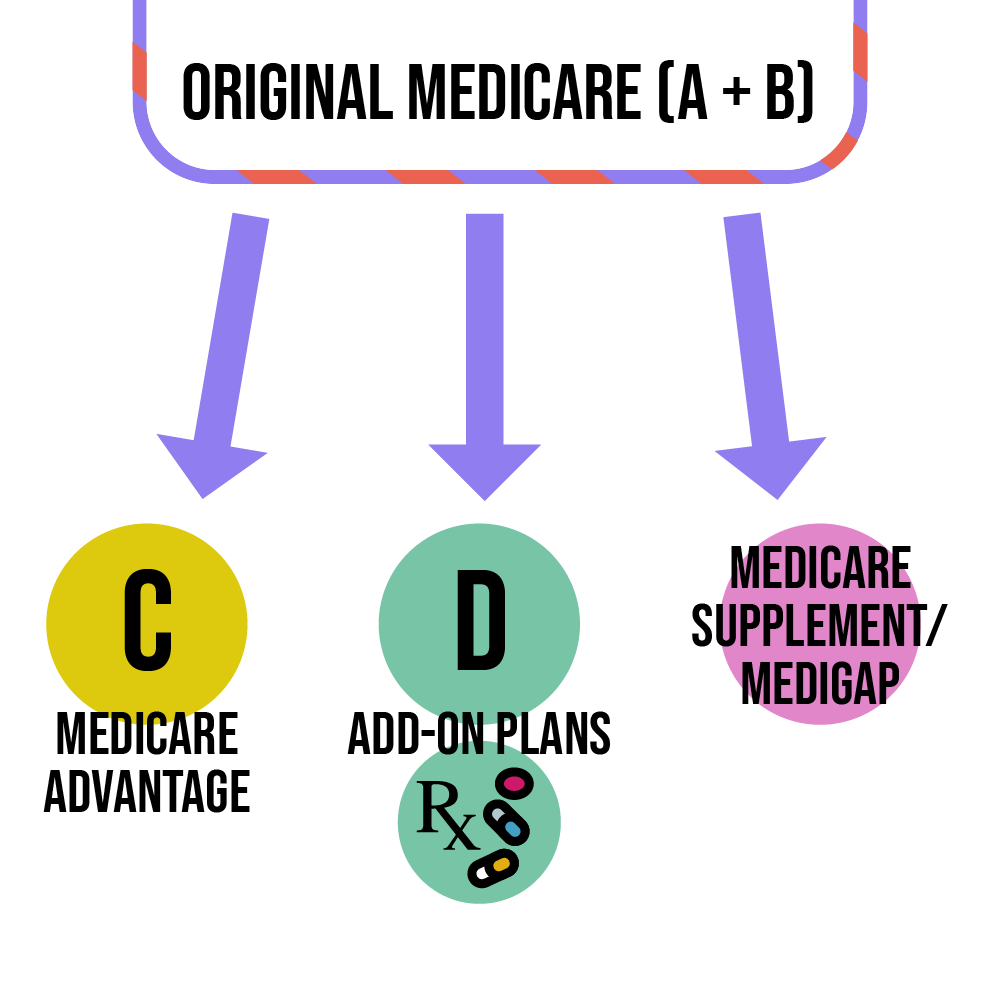

During this time, you can begin your Medicare journey by signing up for Original Medicare (Parts A and B) at ssa.gov. Once you’ve enrolled in Original Medicare, you can purchase additional Medicare plans (from private insurance companies), such as:

- A stand-alone Medicare prescription drug plan (Part D)

- A Medicare Advantage plan (Part C)

- A Medicare Supplement plan

If you don’t sign up for Medicare Parts A and B or Part D when you’re first eligible, you could face penalties in the form of higher premiums. Read more about avoiding penalties.

Breaking down the parts of Medicare

Medicare is made up of four different parts – Parts A, B, C, and D. Each part offers a different kind of health care coverage. It’s important that you understand the different parts cover, so you know which ones to choose for your coverage.

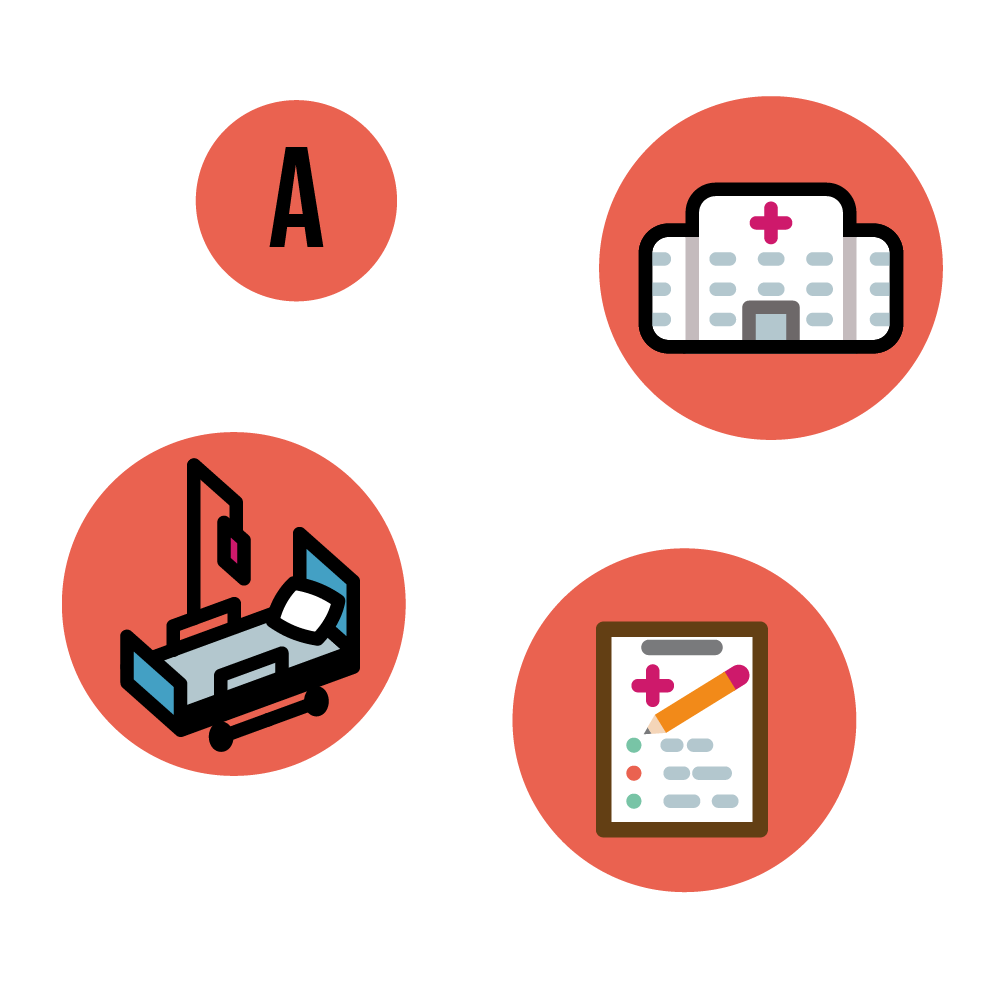

Medicare Part A – Hospital Coverage

Part A is hospital insurance from the federal government. It helps cover:

- Inpatient hospital stays

- Limited stays in skilled nursing facility after you leave the hospital

- Hospice care

- Some home health care

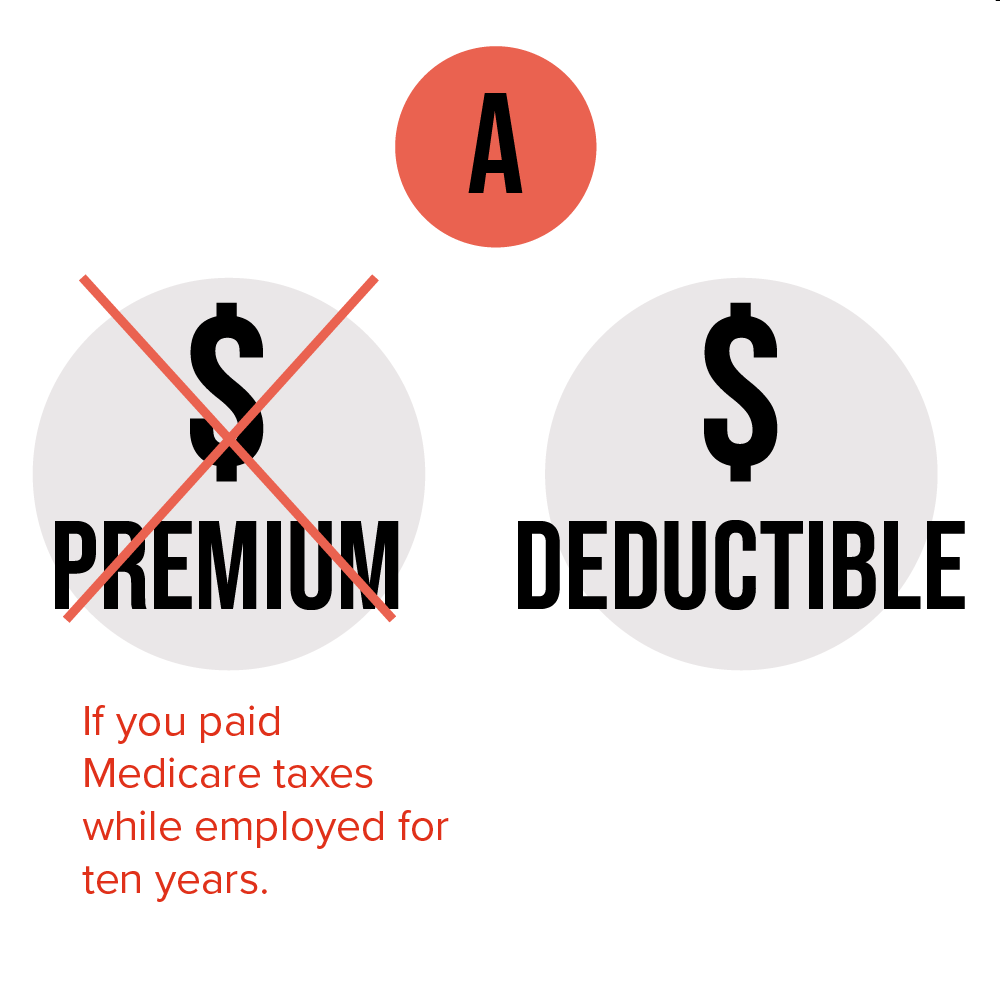

What does Medicare Part A cost?

Most people don’t pay a monthly premium[about premiums] for Medicare Part A. If you or your spouse were employed for at least 10 years and paid Medicare payroll taxes, you’ll be exempt from paying the Part A premium. But you will need to pay a deductible[about deductibles] before Medicare starts to cover any hospitalization costs.

Medicare Part B – Coverage for doctor visits and more

Part B is medical insurance from the federal government. It pays for services like:

- Doctor/specialist and other health care provider visits

- Some outpatient procedures (even if they occur at a hospital)

- Diagnostic tests

- Durable medical equipment, like wheelchairs, walkers and oxygen equipment

- Certain preventive services

What does Medicare Part B cost?

Most people need to pay a monthly premium[about premiums] to maintain their Part B coverage. Your income determines how much you have to pay each month. You’ll also need to pay a deductible[about deductibles]before Part B begins paying for service, and coinsurance[about coinsurance] when you receive your service.

Please note, it’s important to enroll when you first become Medicare eligible at age 65, otherwise you could have a late enrollment penalty tacked onto your monthly premiums.

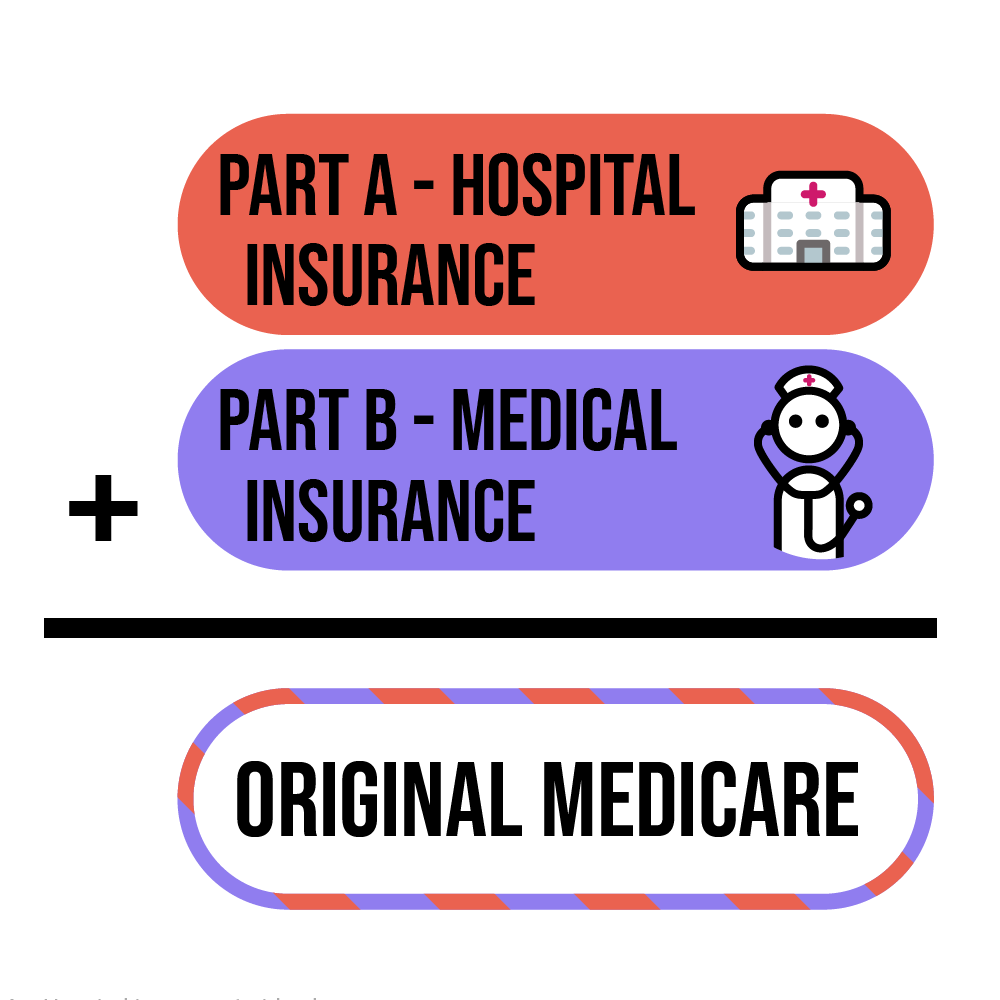

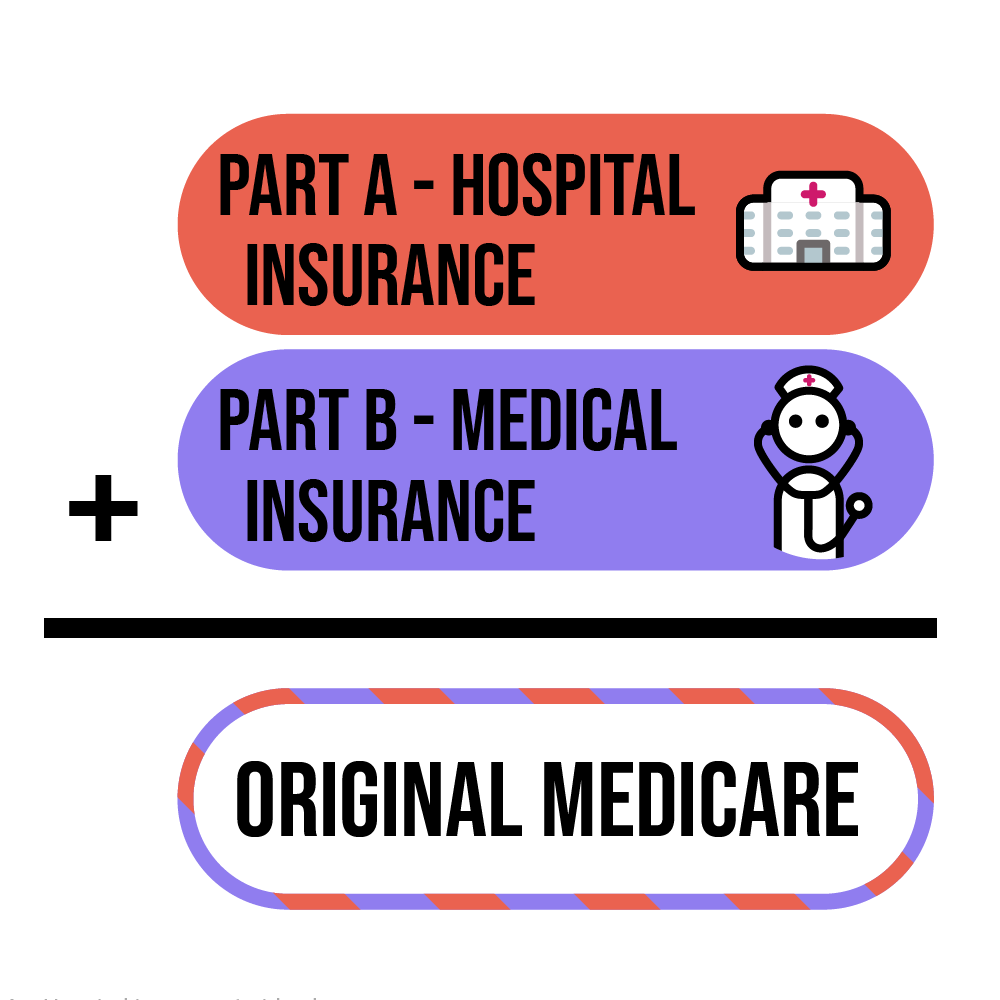

Medicare Part A + Medicare Part B = Original Medicare

Parts A and B together are known as ‘Original Medicare’. The federal government first created them to provide coverage both in and out of the hospital – hence the name ‘Original Medicare’.

Note: you must be enrolled in Original Medicare before you can sign up for add-on coverage or Medicare Advantage from private health insurance companies.

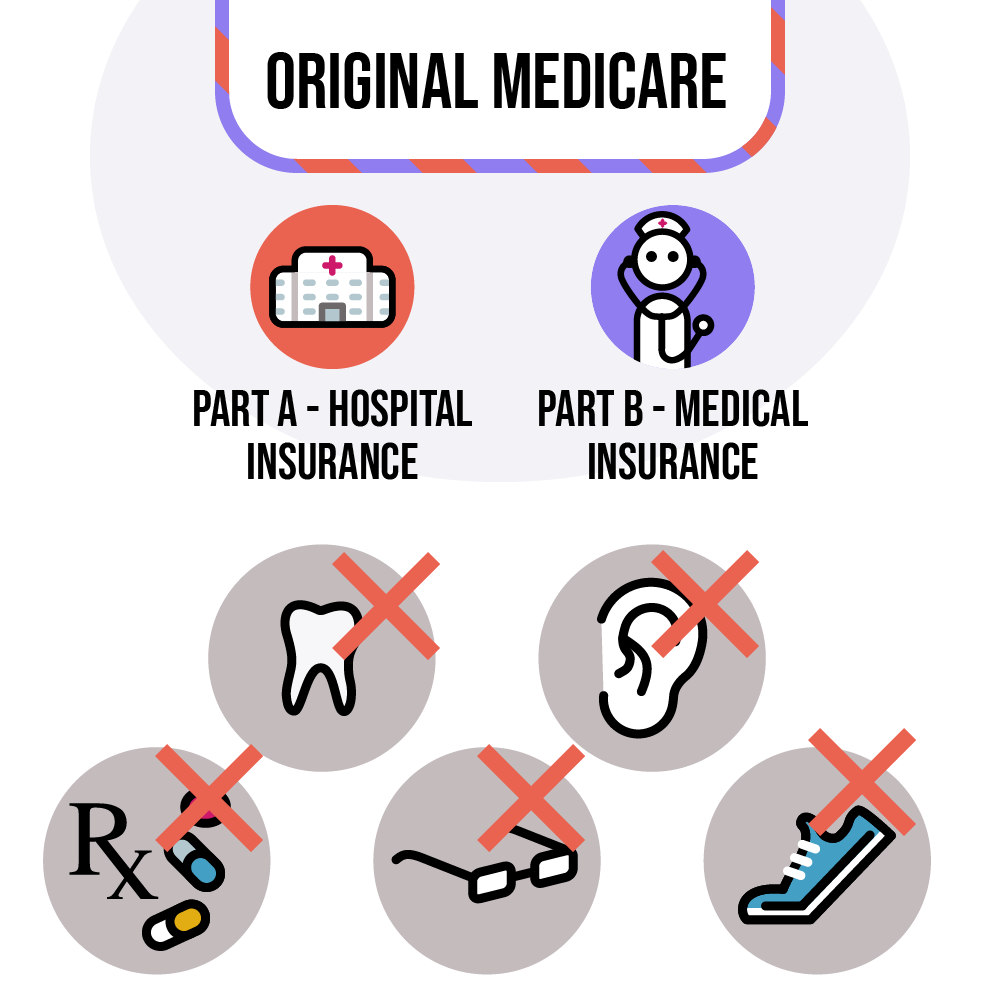

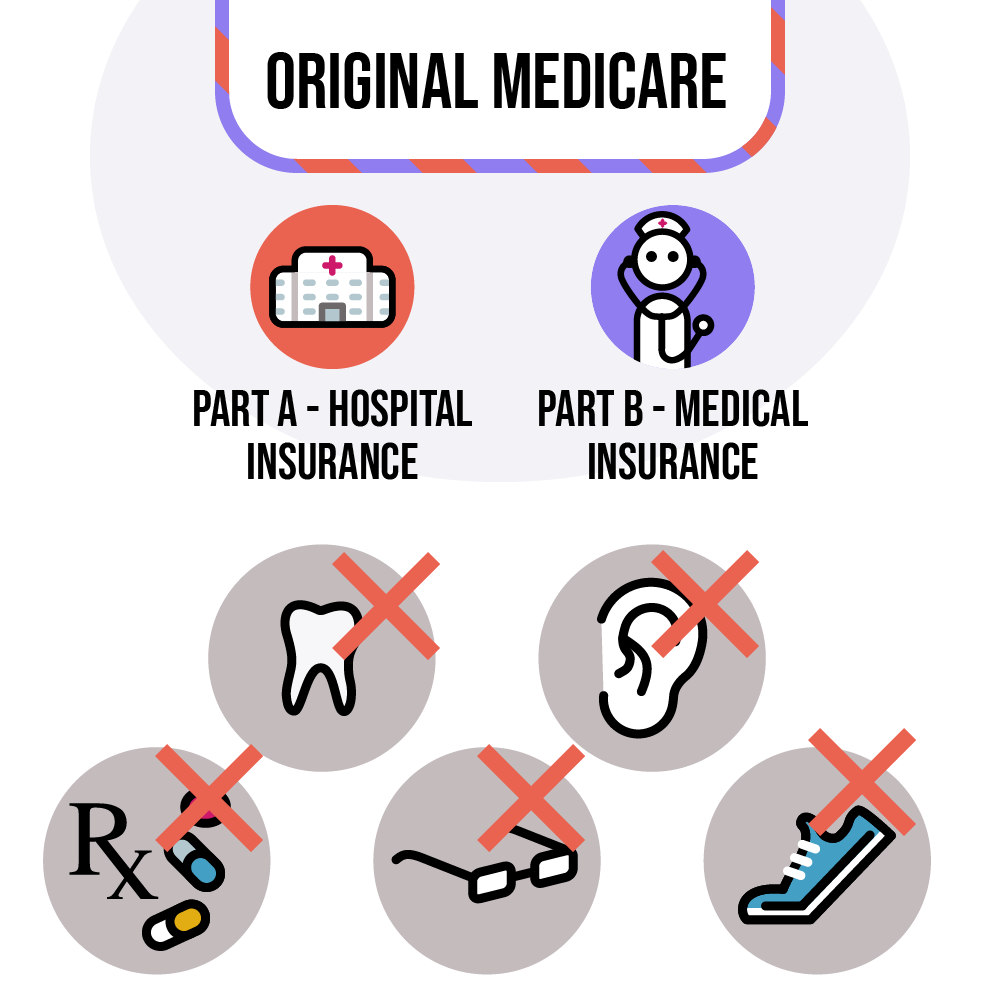

Original Medicare Coverage Gaps

Medicare Parts A and B don’t cover all of your costs, and some services are not covered at all.

Original Medicare usually pays 80%, leaving you to pay the remaining 20% of costs for services. You’ll need to pay out-of-pocket for the following:

- Some prescription drugs

- Deductibles and copays for hospital stays

- Routine dental

- Routine vision care and eyewear

- Routine hearing exams

- Fitness memberships

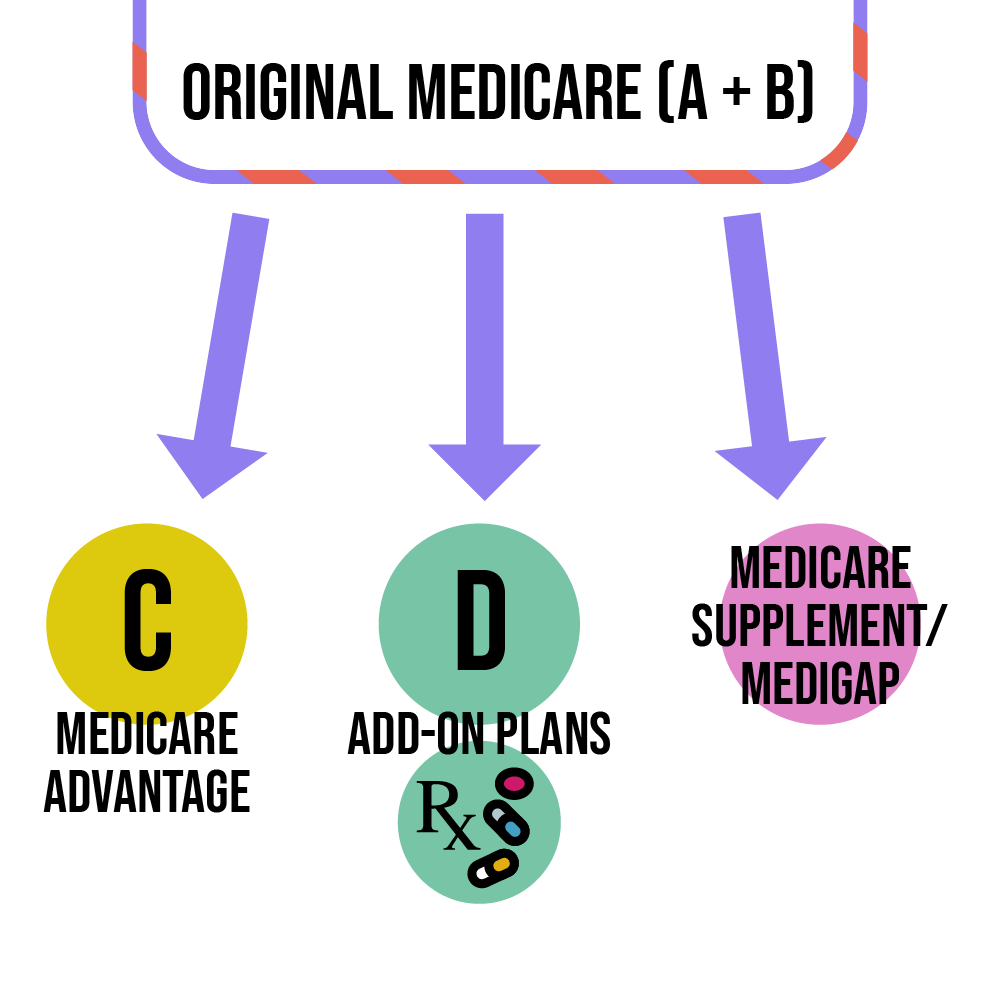

Additional Coverage

Many people choose to buy additional coverage from private health insurance companies to cover the 20% gap that Original Medicare doesn’t cover. Additional coverage options include:

- Part C (Medicare Advantage plans), single all-in-one plans which pull together all the services covered by Parts A and B, and may also include Part D

- Part D (Prescription drug plans)

- Medicare Supplement (Medigap) plans which ‘supplement’ Original Medicare

Part C – Medicare Advantage

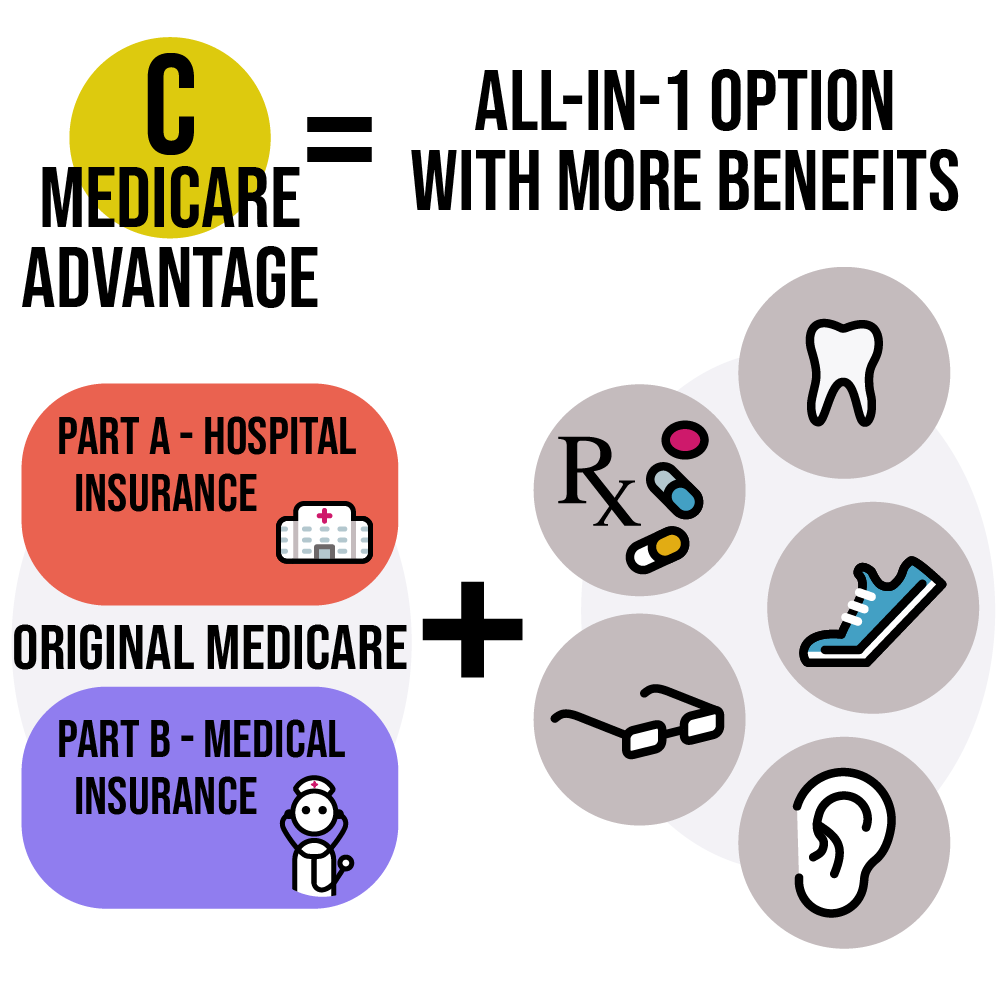

Part C (also known as Medicare Advantage) are plans offered by private insurance companies approved by Medicare. They’re sometimes known as the “all-in-one” option, as they pull together coverage of the following services into one single plan:

- Parts A and B in Original Medicare

- May also include Part D (Prescription Drug Plan)

- May also include dental, vision and hearing

Please note: Before you can sign up for a Medicare Advantage plan, you need to enroll in Original Medicare.

More things to know about Medicare Advantage

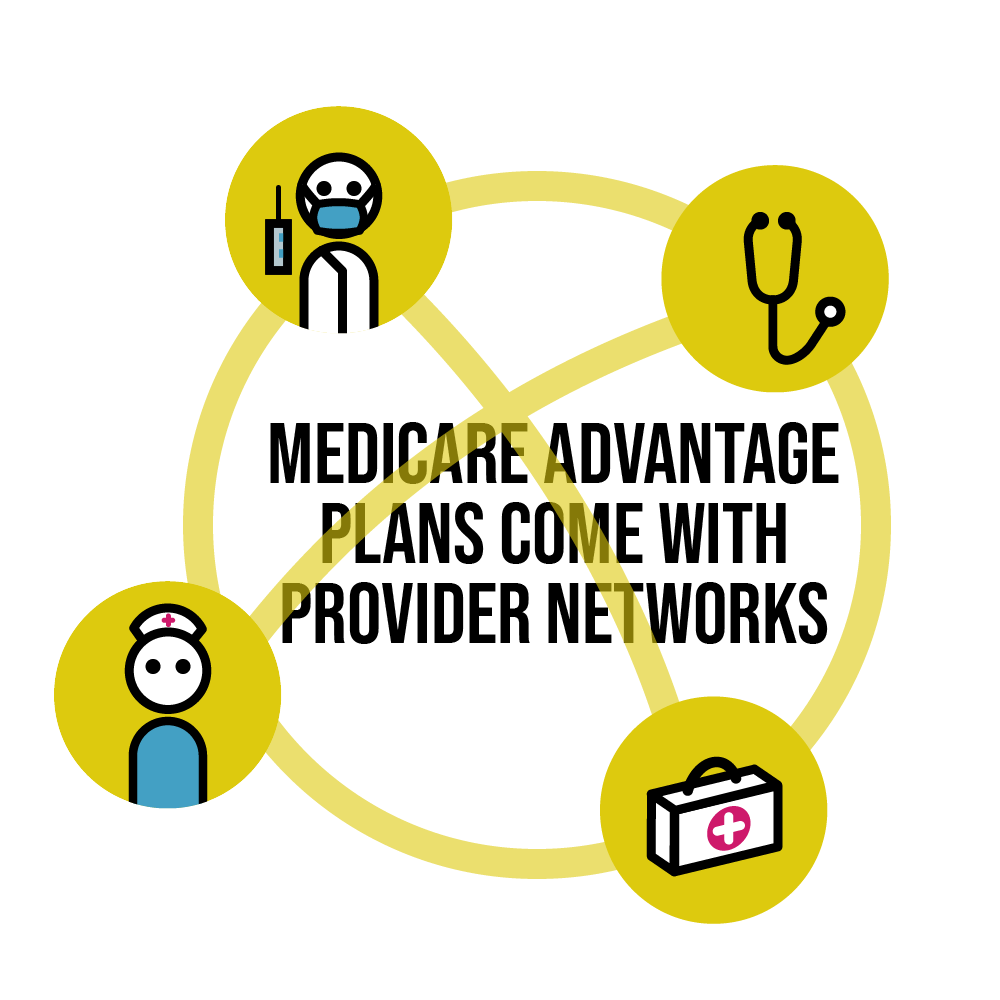

Medicare Advantage plans are made up of networks of health care providers. This is different from Original Medicare, which allows you to visit any provider in the country.

Networks can be more efficient in delivering care. As a result, they reduce overall health care costs. Some Medicare Advantage plans require you to use their network of providers. Others allow you to go out-of-network, usually for a higher cost.

What does Medicare Part C/Medicare Advantage cost?

Medicare Advantage plans’ costs vary from plan to plan. Most have a monthly premium[about premiums] – although for some, the premium is as low as $0. You’ll also have to pay deductibles[about deductibles] and copays[about copays] until you reach your out-of-pocket maximum[about the out-of-pocket maximum].

You’ll also continue to pay your monthly payment for Medicare Part B coverage.

Medicare Part D – Prescription Drug Plans (PDP)

Because Original Medicare doesn’t cover most prescriptions, many people purchase a Medicare Part D plan. These are add-on plans that help pay for prescription medications available from a pharmacy or through a mail-order pharmacy service. They are offered by private health insurance companies, but are regulated by the federal government.

To be clear, you need to be enrolled in Original Medicare before you can add on a Prescription Drug Plan/Part D. That’s why they’re called add-on plans.

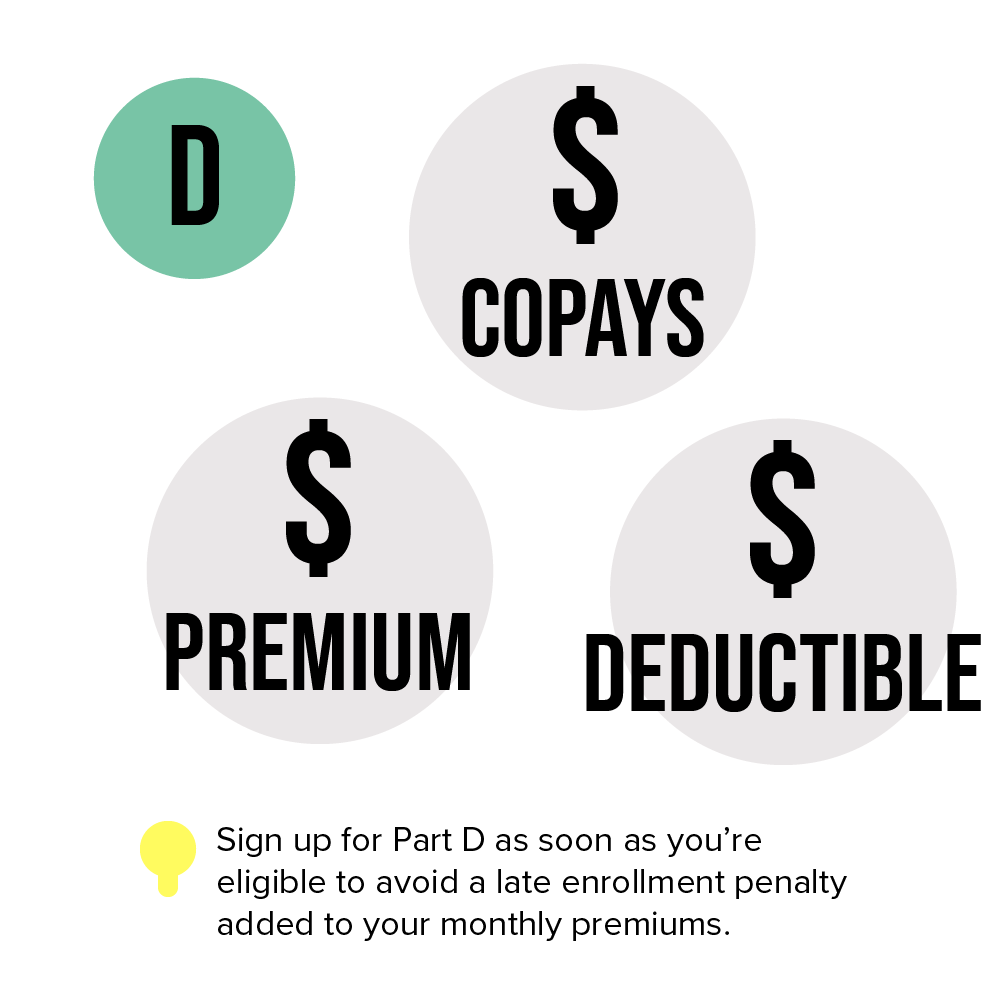

What does Medicare Part D cost?

Depending on the Part D (or Prescription Drug Plan) you choose, you may pay a monthly premium, and sometimes an annual deductible and copays.

Please note: If you decide to buy Part D (PDP) as add-on coverage to your Original Medicare, it’s smart to sign up for it as soon as you become eligible (age 65). Otherwise, if you sign up late, you’ll face a permanent late enrollment penalty tacked onto your premium.

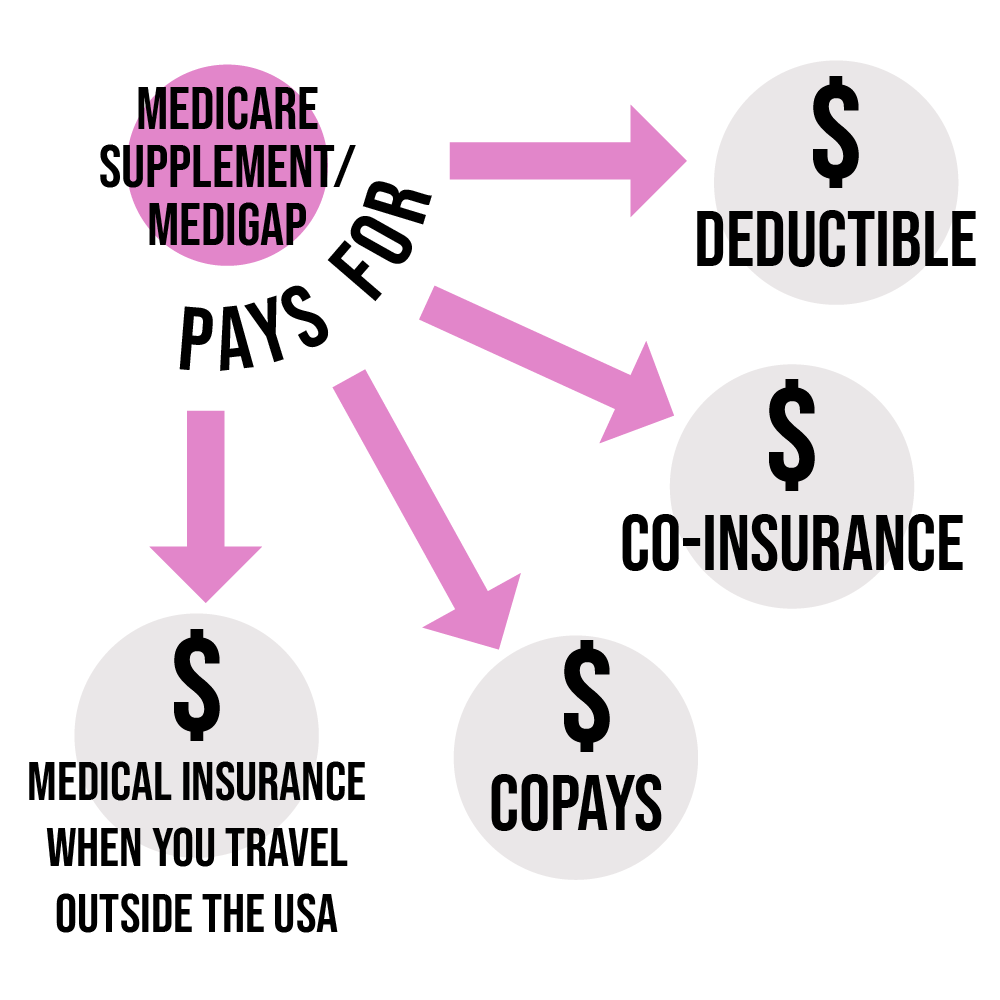

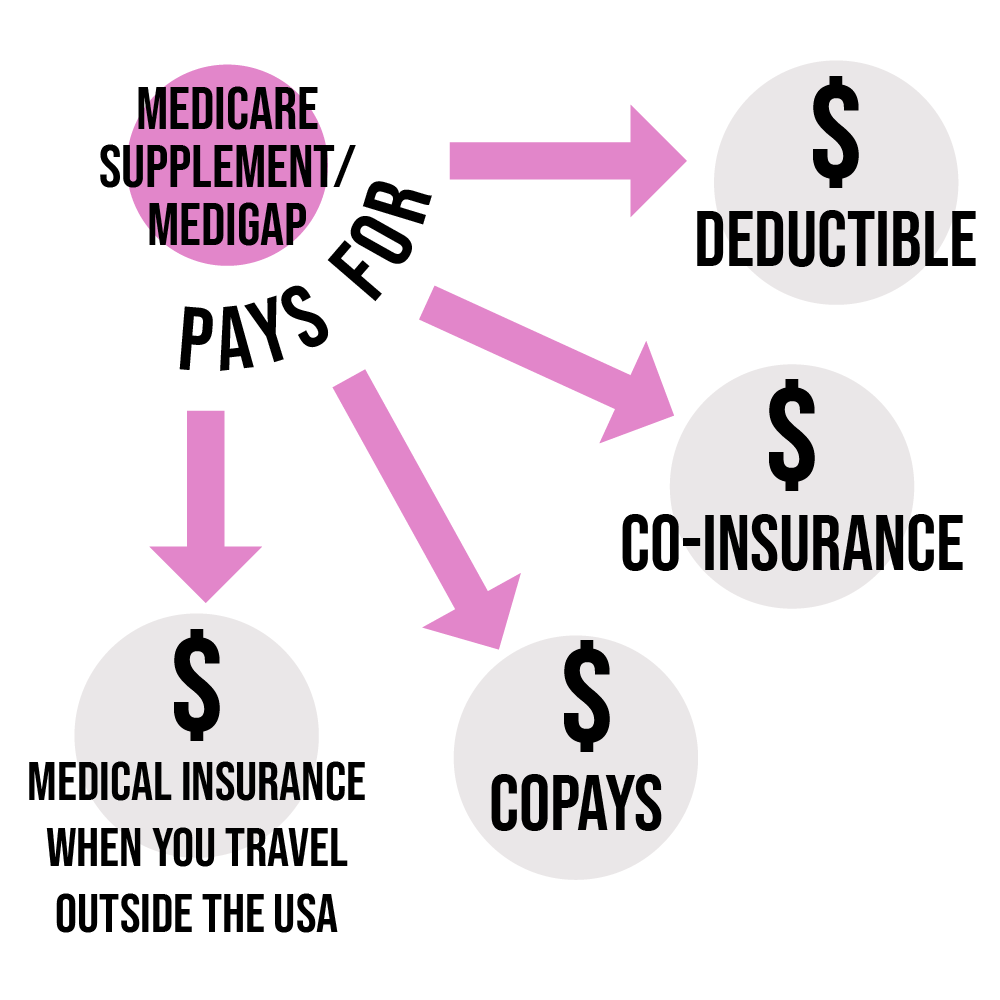

Medicare Supplement (aka Medigap)

Like their name suggests, Medicare Supplements are add-on plans that “supplement” Original Medicare. They help pay your share of health care costs that Original Medicare doesn’t cover, like:

- Deductibles

- Copays

- Coinsurance

- Medical coverage when you travel outside the United States

Please note, Medigap plans don’t have prescription coverage. If you decide a Medigap plan is right for you and you want prescription drug coverage, you’ll need to purchase a separate Part D plan.

More you should know about Medicare Supplement Plans

- They are sold by approved private health insurance companies

- They are only available to people who have Original Medicare alone, with no other coverage

- There are 10 standardized Medicare Supplement plan types regulated by state and federal government

- You may have to answer health questions to qualify

- There may be a waiting period for coverage for pre-existing conditions

- These plans don’t have networks, so Medicare Supplement members can go to any doctor or hospital that accepts Original Medicare

What Medicare Supplement plans cost: Private health insurance companies charge a monthly premium for these plans. The cost of the premium varies with the plan, as well as things like your age, whether you use tobacco and your zip code.

Weighing up your options -- Medicare Advantage

This option may be good if you:

- Want an all-in-1 plan that bundles everything together, including prescription drugs and extra benefits (dental, vision, hearing)

- Want a lower monthly premium and are okay with paying deductibles and copays for health care services

- Are okay with getting care within a defined provider network

Weighing up your options -- Medicare Supplement + Original Medicare

This option may be good if you:

- Can afford to buy extra benefits (like prescription drugs, dental vision etc.) separately

- Are okay with paying a high monthly premium in order to limit deductibles, copays & coinsurance when you receive health care services

- Want the freedom to access any doctor/hospital throughout the US

Your plan checklist

Whether you’re considering a Medicare Advantage, Medicare Supplement or a Part D plan, you’ll need to figure out what your priorities are. Here are some questions to consider:

- Is your doctor covered?

- Does the plan offer a wide provider network of doctors and hospitals?

- Is your pharmacy covered?

- Will the plan cover your prescriptions?

- Do the plan’s costs (like premiums or deductibles) fit into your budget?

- Does the plan offer extra benefits, like:

- Preventive care for $0 copay?

- Dental, vision and hearing aid coverage?

- Free gym/fitness membership?

- No referrals to see specialists?

- Affordable prescription drug coverage?

Your next step – choosing a plan

Choosing a plan can be confusing. Your best way to save time, peace of mind and money is let me guide you through the process with targeted questions, to find out what’s most important to you. I’ll help you quickly narrow your choices down to the top 2 or 3 plans and make your final pick. I’ll also help you sign up.

To get my help, call me at (919) 964 0704. Or, set up a meeting with me by clicking here.